Learn how to use order flow to trade futures in a classroom environment

emoji trading’s classroom training courses provide a relaxed, interactive and engaging learning experience designed to give you:

- a strong understanding of order flow

- understanding of and access to advanced order flow concepts for event analysis, entry triggers and trade management

- a systematic approach to defining trade setups to which automation and partial automation can be applied

COVID-19 Update

With ongoing travel uncertainties, our classroom training is suspended.

Click here for details of Order Flow Training Bootcamps that we are running online.

Course Details & Schedule

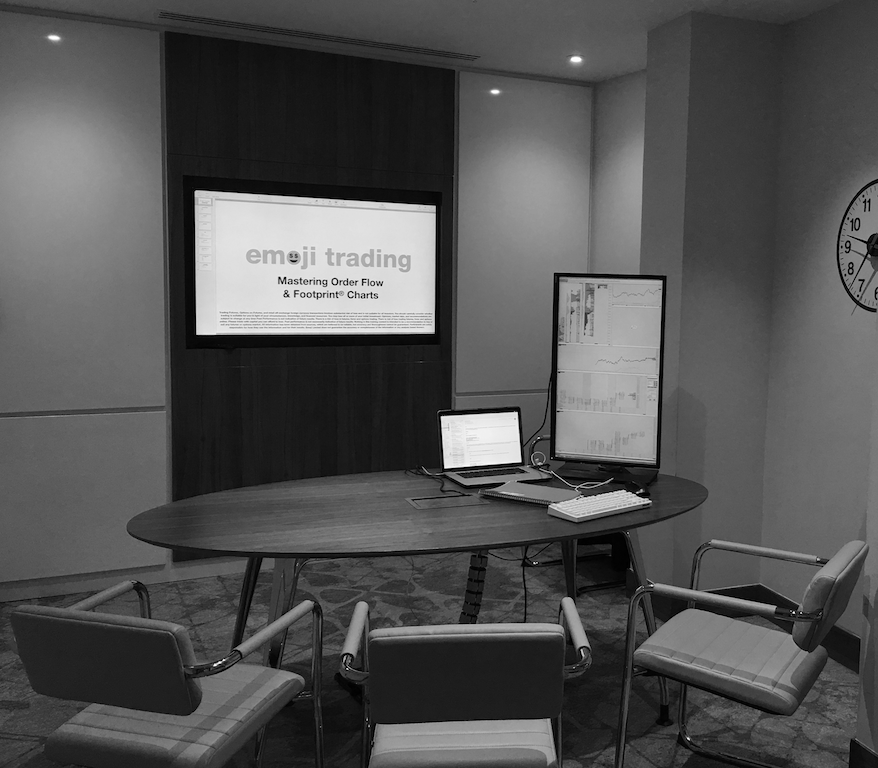

Our order flow training courses are held in professional conference facilities with convenient transport links and accommodation availability. USA- and UK-based courses are conducted in English.

I can’t attend a course because of travel/time/cost. Do you have recordings or web access to classroom training for me/my trading colleagues?

We do not. The value of classroom training is the interaction, Q&A and evolution of understanding. We offer individual coaching if travel or time restricts you from coming to an emoji trading training course.

If you are interested in a group training event we are happy to come to you and deliver bespoke content from our courses. Please let us know what you need using this form:

Group Training Enquiry

Classroom Courses

Designed to equip a trader who is new to futures with sufficient knowledge and terminology to be able to participate in other emoji trading training, this one-day course explains: the participants within futures markets and their objectives; multi-timeframe analysis of supply and demand areas with market profile and volume profile analysis and an understanding of day types and market phases; significance of information that is not time-based; fundamentals and the effect of news, economic announcements; understanding the order book; self-awareness and psychological considerations vs one’s trading account

Prerequisites: a basic understanding of trading, e.g. equities, simple retail forex.

Duration: 1 day

Price: $750

By taking this course you will learn how to read the Footprint chart and understand the key order flow concepts of Exhaustion, Absorption, Aggression, Delta and Unfinished Business. You will learn how to identify these concepts from the raw volume data, their significance and what you can infer and act upon.

With this understanding, built up from first principles you will learn how to effectively apply emoji order flow indicators (or other features of your own trading platform), not as a black box, but as a visualisation and calculation aid that allows for simpler and less distracted decision making. The basis for specific order flow indicator calculations will be explained and it will become apparent how, when and why to apply and act on order flow events as they happen and as levels are revisited.

Prerequisites: a solid understanding of futures trading terms and concepts including: order types and placement using a DOM; futures contracts and trading hours; awareness of market profile and volume profile concepts and terminology; basic technical analysis – common chart patterns and indicators. If you have no experience trading using a DOM or Level 2 data, e.g. your background is retail equities, options or basic forex we recommend attending Fundamentals of Futures Trading in order to understand the terms and basic concepts referred to within this course.

Duration: 2 days

Price: $1500

This course introduces emoji trading's latest advanced concepts in interpreting aggressive trading, exhaustion and absorption combined with tools and methods to evaluate order book liquidity in conjunction with order flow traded volume. These techniques are applied to higher timeframe and contextual analysis, entry timing and triggers and in-trade management. The mechanisms and principles behind these concepts will be explained from first principles.

Prerequisites: fundamental understanding and experience of interpreting order flow and using Footprint ® charts. Attending this class immediately after Mastering Order Flow & Footprint Charts is not recommended, rather, we suggest allowing at least 3-6 months to allow the concepts of the first course to be applied to actual trading before exploring advanced analysis methods.

Duration: 2 days

Price: $1500

Learn how order flow and market context can provide a systematic framework for day trading with various setups. This course provides examples of using order flow to build setups that can be applied to day trading for entries, exits and in-trade scaling-in and leverage. Having defined these setups, we will explain how you can use platform features and add-on tools for alerts, entry/exit automation, semi-automation and scaling-in. Upon completion one will have a good foundation in designing, testing and assessing trading approaches and systems based upon logical order flow principles and be equipped to use them manually or in conjunction with automated trading tools.

Prerequisites: fundamental understanding and experience of order flow and Footprint ® charts. While this course refers to content delivered in the Advanced Order Flow Analysis course, attending this course is not a prerequisite and it is feasible to combine this course with Mastering Order Flow & Footprint Charts.

Duration: 1 day

Price: $750

Please select your desired training courses, locations and dates to book. Full training course terms and conditions are available here. After we have processed your booking you will receive detailed course joining instructions, venue details and recommended pre-work.