Delta Divergence Pro highlights Exhaustion by analysing different forms of Delta Divergence. We look for Exhaustion at the extremes of price bars. Delta Divergence is telling us when the delta across price bars is not moving in the same direction as price. We are effectively stretching the Exhaustion that we would see at the extreme of a slower price bar across a number of faster price bars.

In addition to highlighting Delta Divergence and Cumulative Delta Divergence, you can use Delta Divergence Pro to identify sequential decline in Delta, i.e. a sequence of falling or rising delta bars. This provides a sense of the direction in which delta is trending.

Indicator Settings & Outputs Reference

The Delta Divergence condition can be filtered using the Price Reversal Filter.

You can apply the emoji Advanced Lookback Filter to Delta Divergence conditions to limit visualization to those conditions happening at relative highs and lows.

Entering a value of 3 or higher will visualize when Delta is falling or rising above the selected quantity of chart bars.

Select whether a sequential decline condition must cross the zero line, i.e. change from positive to negative (or vice-versa) in order to trigger.

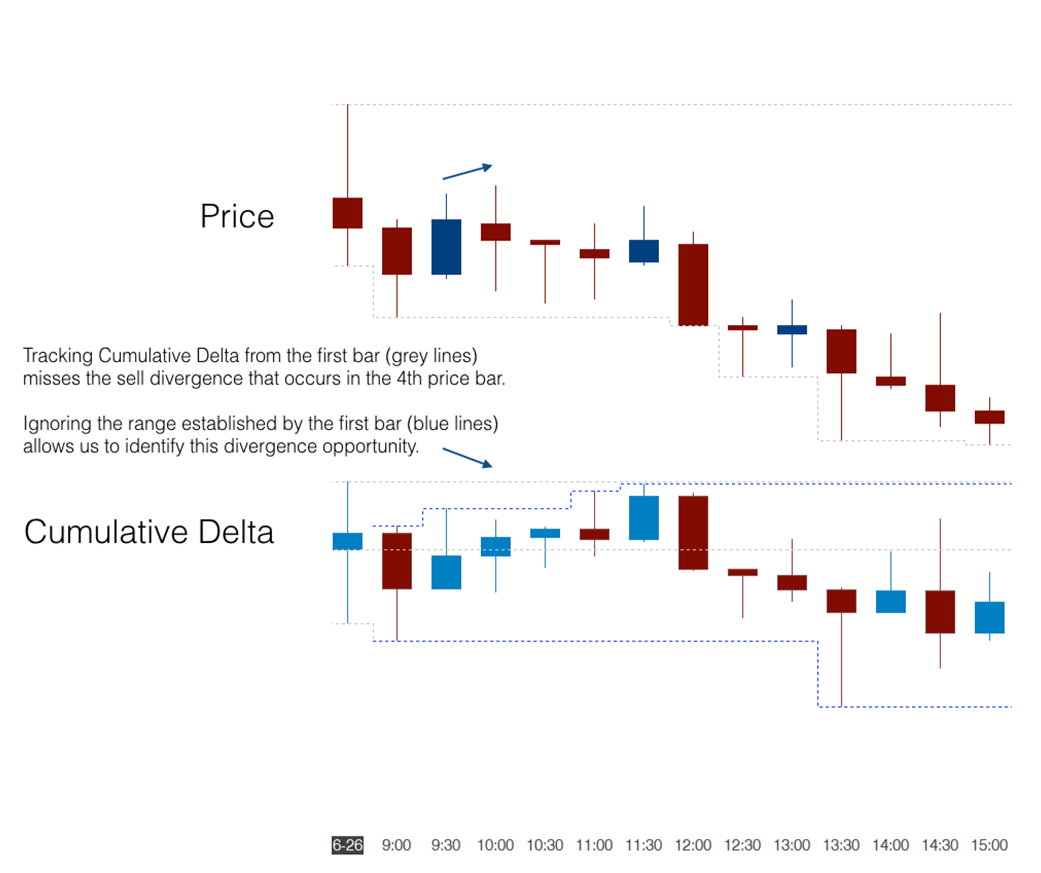

Within a trading session, the first bar’s Cumulative Delta will always have a high or a low value of zero. This zero value can result in missed divergences – Cumulative Delta may stay above or below zero for the entire session.

Set this setting to Yes to ignore the first bar’s Cumulative Delta and start tracking the high/low from the second bar of the session.

Select whether Delta Divergence is recognised when:

• HH + <= / LL + >=

Either…

…price makes a higher high (based upon the settings in the Advanced Lookback Filter) and Delta is less than or equal to its highest value during the same period, or

…price makes a lower low (based upon the settings in the Advanced Lookback Filter) and Delta is greater than or equal to its lowest value during the same period

i.e. at higher prices, Delta is relatively lower – aggressive buying is falling; at lower prices Delta is relatively higher – aggressive selling is falling

• Opposing

Either…

…price makes a higher high (based upon the settings in the Advanced Lookback Filter) and Delta is negative, or

…price makes a lower low (based upon the settings in the Advanced Lookback Filter) and Delta is positive

i.e. at higher prices, Delta is negative – we have aggressive selling; at lower prices Delta is positive – we have aggressive buying

Select which type of Delta is analysed:

• Bar: the value of Delta in each price bar

• Cumulative: the cumulative sum of Delta since the start of the Advanced Lookback Filter period

The number of ticks away from the bar high/low that the Supply/Demand indicator Output Signals are drawn.

This indicator provides:

• Output Signals