When an emoji indicator identifies a pattern within the order flow traded volume representing a notable Supply/Demand Event it stores the associated price levels and the emergence of New Supply or New Demand within your computer’s memory.

These New Supply and New Demand events are tracked and analysed as the market revisits these levels using price and order flow traded volume to determine whether the identified levels are likely to hold or break.

An identified level travels forward through the states listed below until the end of the cycle.

…for example, a price level representing New Demand may re-trade and enter the Exhausted Demand state (or become New Supply) as the patterns of traded volume when the price level retraded suggest that the level would not hold (or have broken change the price level from an area of Demand to one of New Supply).

EmojiZone Supply/Demand states

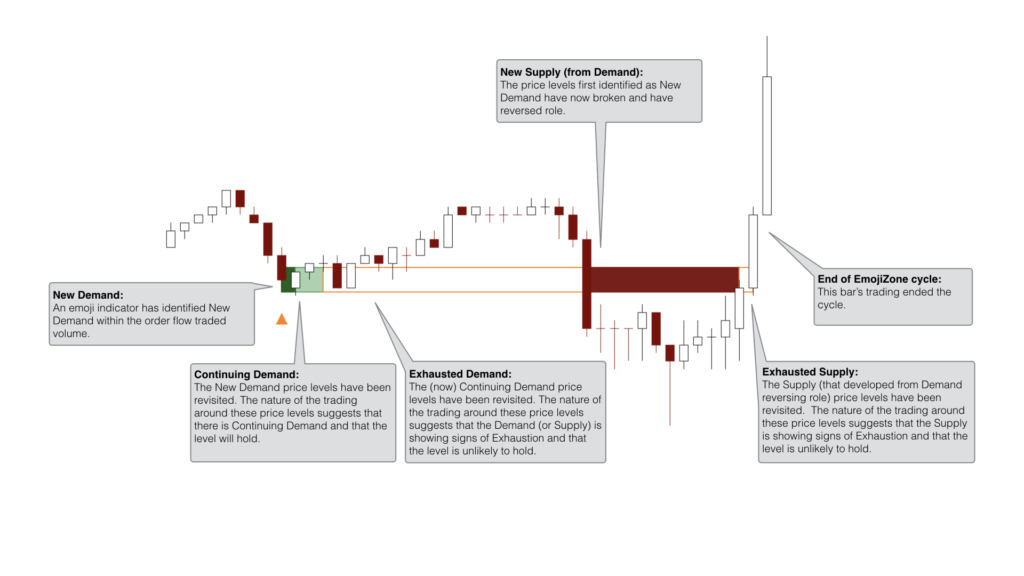

- New Demand (or Supply)

The indicator has identified a pattern within the order flow traded volume representing a notable Supply/Demand Event.

- Continuing Demand (or Supply)

The price levels identified as New Demand (or Supply) have been revisited. The nature of the trading around these price levels suggests that there is Continuing Demand (or Supply) and that the level will hold.

- Exhausted Demand (or Supply)

The price levels identified as New Demand (or Supply) have been revisited. The nature of the trading around these price levels suggests that the Demand (or Supply) is showing signs of Exhaustion and that the level is unlikely to hold.

- New Supply from Demand (or New Demand from Supply)

The price levels first identified as New Demand (or Supply) have now broken and have reversed role.

If you do not want identified price levels to reverse role, you can use the Dynamic Mode State Reversal setting to end the cycle at this point once the Exhausted Demand (or Supply) level has broken. - Continuing Supply (or Demand)

The Supply (that developed from Demand reversing role… or Demand that developed from Supply reversing role) price levels have been revisited. The nature of the trading around these price levels suggests that there is Continuing Supply (or Demand) and that the level will hold.

- Exhausted Supply (or Demand)

The Supply (that developed from Demand reversing role… or Demand that developed from Supply reversing role) price levels have been revisited. The nature of the trading around these price levels suggests that the Supply (or Demand) is showing signs of Exhaustion and that the level is unlikely to hold.

- At the end of the EmojiZone cycle…

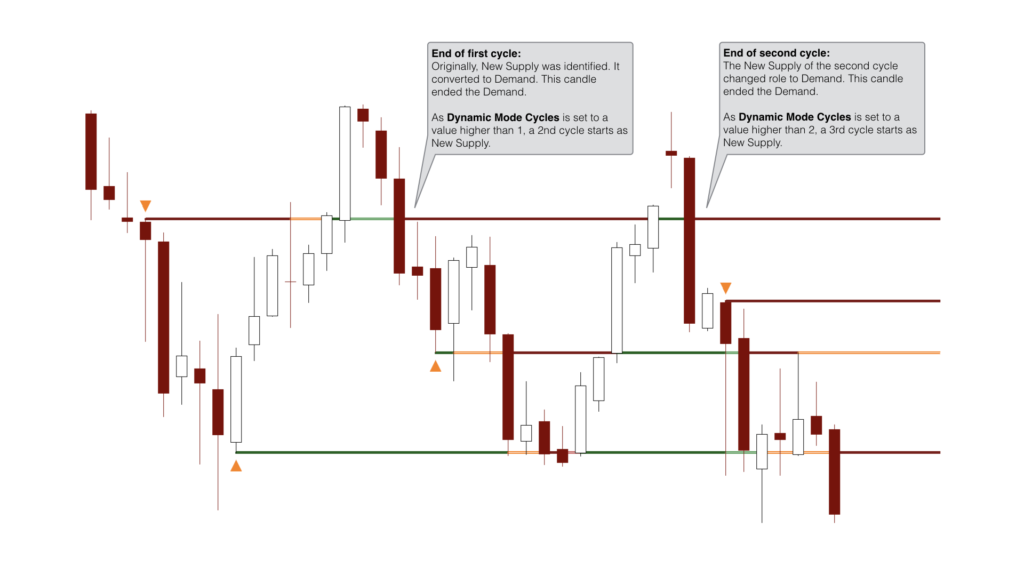

…the level is no longer tracked, however by selecting a Dynamic Mode Cycles setting larger than the default value of 1, at the end of the cycle, the price level will move back to its first state and continue being tracked until the selected number of cycles have completed.

This can be very useful on analysis of longer term charts, for example using the Small Prints indicator on a daily chart to highlight Zero Prints within the body of the bar.