Order Flow is a term widely used in trading but not necessarily well understood or defined by those either advocating it or criticising it!

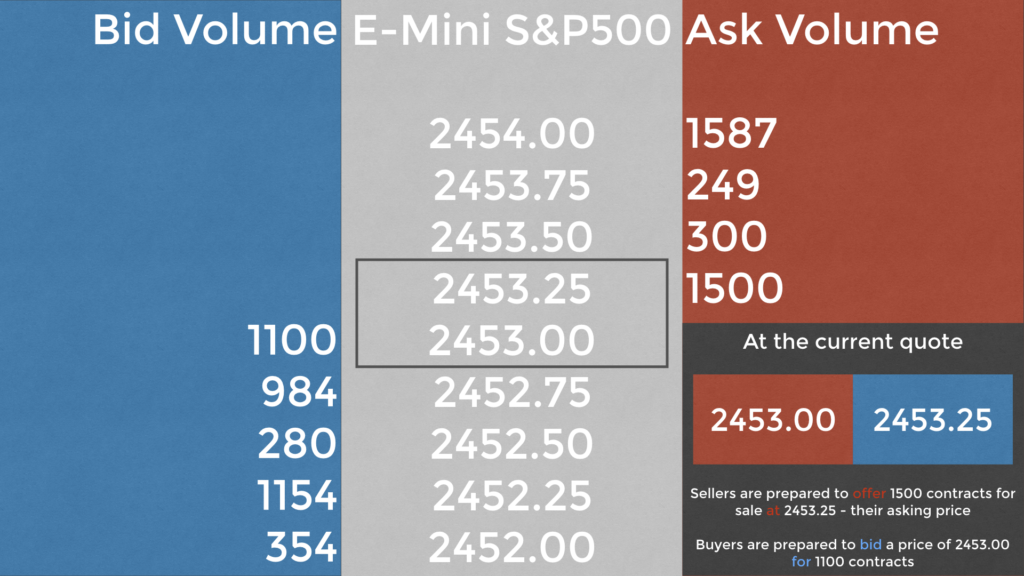

For the purposes of this guide we define Order Flow analysis as studying and making decisions based upon the orders placed within a financial market by traders within that market. The market’s current price is expressed as:

- the price if you wish to buy: this is known as the Ask or Offer price. It is the price that sellers are Asking you to pay or Offering to sell at

- the price if you wish to sell: this is known as the Bid price. It is the price that buyers are prepared to Bid for what is traded in the market

- the ‘bid for’ and ‘sell at’ phrases are how trading pits using open outcry and hand signals enabled communication between buyers and sellers. Buyers would bid price X for quantity Y; Sellers would offer quantity Y at price X

Many new or retail traders never consider the mechanics of the market and who is the counterparty that they are buying from or selling to. As we develop our ability to read order flow information we see the importance of interpreting the actions of all of the market participants in order to trade in alignment with the dominant

Traders buy and sell within the market using:

- Limit orders

- A Buy limit order is placed below the market’s current price

- A Sell limit order is placed above the market’s current price

- Limit orders may be used to open a new position or close an existing position. Consider them as advertisements for prices where traders are prepared to transact a quantity of business.

- Limit orders provide liquidity to the market, however on their own, they do not facilitate trade. Trade occurs when someone is prepared to trade at the price advertised by a limit order. This occurs by placing…

- Market orders used to open a new position or close an existing position right now… or ‘at the market’.

- A Buy market order is executed at the market’s current ask or offer price. This is known as ‘lifting the ask’ or ‘lifting the offer’. Why lifting? The act of buying will generally raise prices, so we are lifting the market up through the act of buying.

- A Sell market order is executed at the market’s current bid price. This is known as ‘hitting the bid’. Why hitting? The act of selling will generally make prices fall, so we are hitting the market down through the act of selling.

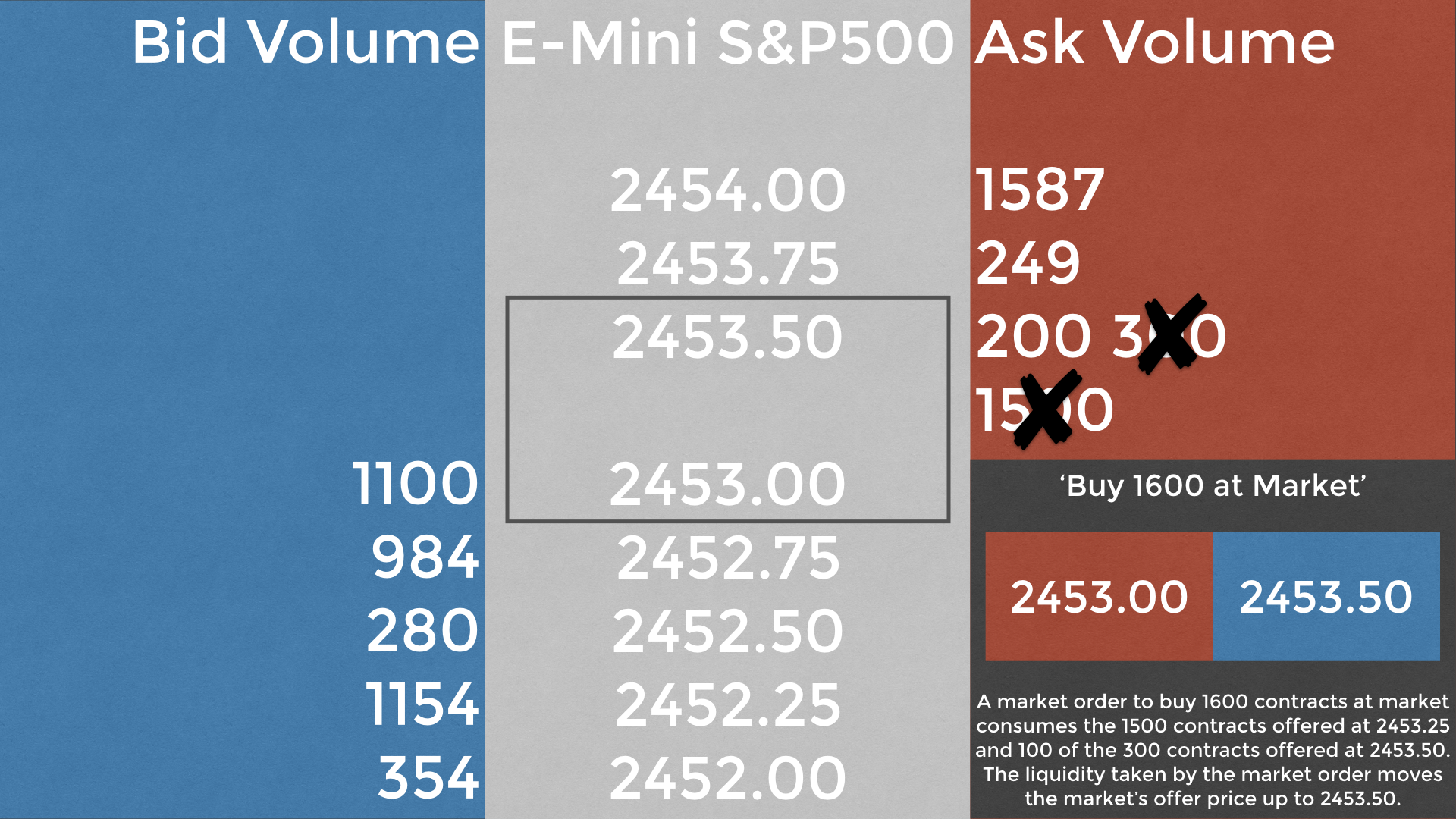

- Market orders fill limit orders and therefore market orders consume liquidity from the market. Another way of expressing this is that a ‘market maker’ provides liquidity and a ‘market taker’ consumes liquidity.

- Price moves because all of the available buying capacity (buy limits) or selling inventory (sell limits) is consumed by market orders. If there are 1500 contracts being offered at 2453.25 and a buy market order for 1600 contacts enters the market, it will consume all 1500 contracts being offered at 2453.25moving the market’s Ask price upwards to the next level where inventory is available.

- During the time between placing a market order and it being executed, price may move due to other trading activity. This is how and why ‘slippage’ occurs, especially in ‘thin’ markets that do not have much liquidity at each price level, e.g. Nasdaq NQ futures, DAX futures by comparison to ‘thick’ markets that have a lot of liquidity at each price level, e.g. 10-year Treasury Note ZN futures

- Stop orders

- These are orders that become market orders once the market reaches the price level of the stop order.

- They are typically used as protective ‘stop loss’ orders for an existing open position, i.e. to exit a long position if the market falls below a specified price or exit a short position if the market rises above a specified price…

- …however they can also be used to enter a position at a price less favourable than that at which the market is currently trading. Why would one want to do this? It is a basic method by which a position can be opened as the market moves in the planned direction of the trade. The trader is sacrificing some profit in exchange for more perceived certainty of the outcome of the trade.

- As stop orders become market orders, they too can be liable to slippage.

- Stop orders consume liquidity when they convert to market orders, but they can also provide liquidity as like limit orders, they are ‘resting orders’ within the market. Traders will ‘hunt’ stops to perform ‘stop runs’ when they believe that there are large numbers of stop orders around certain levels in the market. Uninformed traders will place their stop loss orders at prices that are very obvious to more experienced traders, e.g. 1-2 ticks behind a very visible price level. This allows more experienced traders to take advantage of the existence of these stop loss orders to exit or enter their own positions while the inexperienced traders complain about how ‘they’ took out ‘my’ stop or wonders why their trade plans consistently seem to get stopped out before continuing in the planned direction leaving them behind…

So very simply, order flow analysis is looking at the trading activity in the market and using this to make trading decisions. Given that price moves because of volume traded, any trader that does not include volume within their trading decisions is at a disadvantage.