Delta is a key concept to understand when making trading decisions based upon traded volume. It’s the difference between the volume of market orders buying by lifting the offer price and the volume of market orders selling by hitting the bid price. In other words, if Delta is greater than zero, we had more buying than selling and if Delta is less than zero, we had more selling than buying.

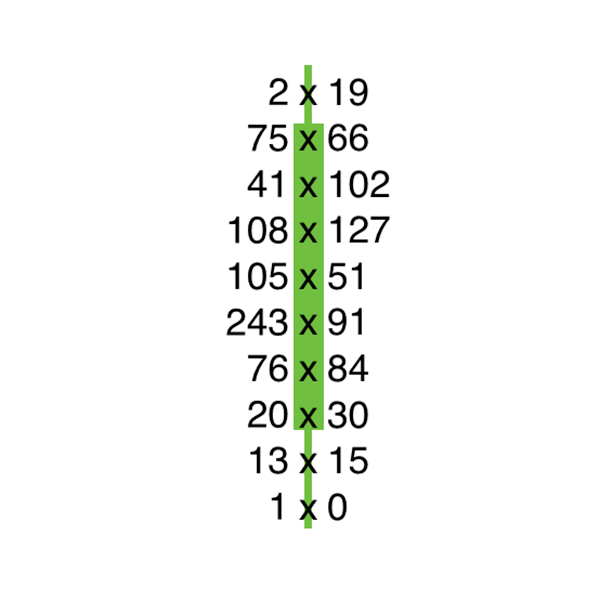

This bar has a Delta of : + 101

Buy market order volume: 0 + 15 + 30 + 84 + 91 + 51 + 127 + 102 + 66 + 19 = 585

Sell market order volume: 1 + 13 + 20 + 76 + 43 + 105 + 108 + 41 + 75 + 2 = 484

585 – 484 = 101

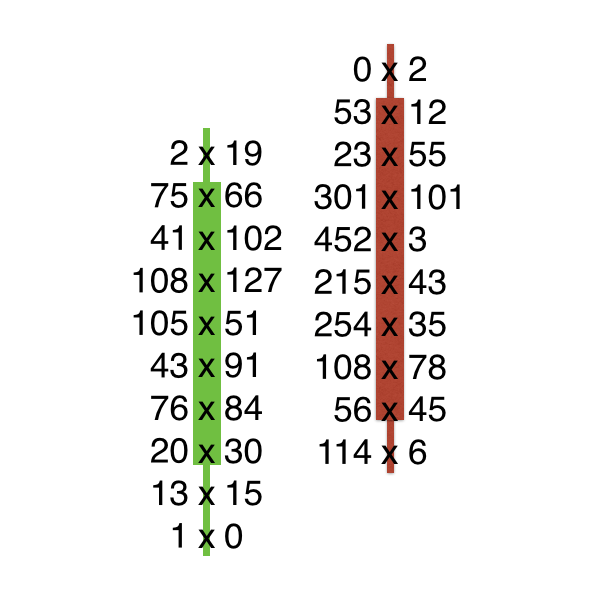

Delta gives us a broad sense for each bar of whether we have more aggressive buying or selling. We can compare Delta between bars to get a sense of whether supply and demand are rising or falling:

Our second bar delta is -1196. What’s happened?

Price has made a new high but there was more selling than buying.

Reading this would not make you feel especially confident about opening a long position. We have Delta Divergence. Delta has not moved in the same direction as price. This is in fact another indication of Exhaustion.

By tracking bar delta at significant highs and lows we can get a broad sense of whether the market is too high or low. We can also track the progression of bar delta through sideways trading ranges to get a sense of whether supply or demand is the dominant force.