Absorption is a key concept to understand in order flow analysis but it can be a little tricky… it requires the ability to ‘see the unseen’ and this is where indicators like emoji trading Absorption Pro can help make it easier.

We explained here how large volume traders simply cannot trade using market orders. Their size will move the market through lack of liquidity and their trading objectives will fail due to trading at unfavourable prices. Our objective however is to be aligned to the direction of the traders that are trading with large volume as we know that volume is what moves price.

Many traders beginning to use order flow analysis fall into a trap of only acting upon signs of aggression by chasing bid/ask imbalances and becoming over-reliant on bar delta. They are forgetting to:

…consider the mechanics of the market and who is the counterparty that they are buying from or selling to. As we develop our ability to read order flow information we see the importance of interpreting the actions of all of the market participants in order to trade in alignment with the dominant

We can analyse the difference in buying and selling volume at each price level – delta at price – in order to understand whether the aggressive traders using market orders or the limit orders of the passive traders were ultimately in control.

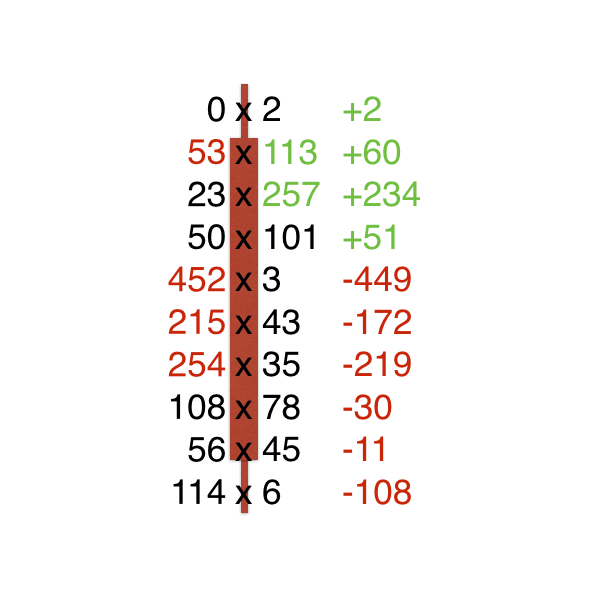

Here we can see the delta at each price level in the bar. Starting from the bar top: 2 – 0 = +2; 113 – 53 = +60; etc. We can see that even though there were aggressive buying imbalances at the top of the bar, ultimately price fell. We have three consecutive selling imbalances – a stacked imbalance – further down the bar so what happened?

The positive delta at the top four price levels shows us there was more aggressive buying than selling. Once we traded lower than these price levels, we could conclude that the passive sell limit orders absorbed the aggressive buying. We know there is exhaustion of buying at the top of the bar as well. So… we ran out of buyers willing to pay the price. Perhaps they sensed that however much volume they bought aggressively, they could not push price higher because the sell limit orders did not disappear. They stopped buying. In fact, some of them aggressively sold to exit their failed long positions in turn driving price lower triggering other sell stop loss orders that traded as market orders. This creates the stacked selling imbalance further down the bar.

If we do not consider or understand absorption we are not getting the full picture of the power of the market participants. We know that large volume traders need to trade using limit orders. If we consider delta at each price level and where we are currently trading relative to positive or negative delta at each price level, we can get a sense of whether passive limit orders have absorbed aggressive market orders.